The Achilles Heel of Renewable Energy

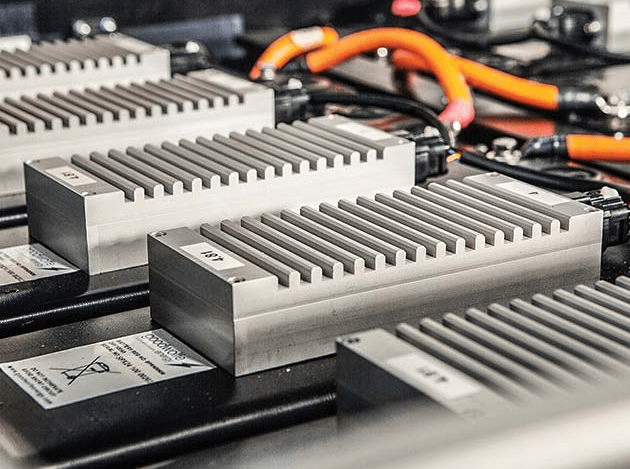

Dependence on Earth’s raw minerals will prove to be the Achilles heel of the green energy transition. To produce the batteries that power electric cars, mining companies plunder the earth for lithium, cobalt, and nickel.

Manufacturing solar panels requires mining for silver, aluminum, and copper. Wind turbine production heavily relies on rare earth elements such as terbium, praseodymium, neodymium, and dysprosium, minerals that sound like Jurassic-era dinosaurs.

It should come as no surprise to any of us: Earth has a finite supply of raw minerals. However, demand for renewable technologies grows exponentially. A depleted supply of raw minerals looms over the green energy transition like dark storm clouds on the horizon.

This two-part blog series explores the environmental, political, and economic dynamics that emerge as the energy sector works hard to continue supplying energy to a global population while also coming to terms with its dependence on a finite Earth.

LITHIUM: a soft, silvery white metal.

In the renewable energy sector, companies use lithium for electric vehicle batteries and battery storage. The origin of the element’s name is thought to come from “lithos,” the Greek word for stone.

The International Energy Agency anticipates the renewable energy sector will dominate 90% of all demand for lithium within the next few decades. In 2020, electric vehicle batteries already accounted for 34% of lithium demand and by 2030, the IEA anticipates electric vehicle batteries will monopolize 75% of all lithium demand.

Can Earth’s supply of lithium meet the surge in demand? Unfortunately, the news is not good. Corinne Blanchard, Deutsche Bank’s director of lithium and clean energy research, forecasts a global deficit amounting to 768,000 tons by 2030. China, an economy with high demand for lithium, anticipates a 20.4% growth in lithium demand through 2032. In contrast, China’s lithium supply is expected to grow only 6% over the same period.

SILVER: a soft, white, lustrous transition metal.

In the renewable energy sector, silver is used when manufacturing solar panels. Together with gold, silver is considered a precious metal because of its comparative scarcity, brilliant white color, and resistance to degrading when exposed to oxygen.

The widespread adoption of solar panels is expected to drive growth in the demand for silver exponentially. Today, solar panels use only 10% of the world’s silver. By 2050, solar panels are expected to demand over 50% from the world’s silver reserves. In addition to solar panels, the rise in popularity for electric vehicles will drive up demand. Electric vehicles are expected to drive demand for silver from 5% of global supply in 2019 up to 15% of global supply by 2040.

Can Earth’s supply of silver meet the surge in demand? Today’s numbers already show stagnation. The supply from existing silver mines has been flat for the past ten years while demand continues to rise. This year, in 2024, silver’s market deficit between demand and supply is expected to grow by 17%. Looking forward to 2050, reports anticipate the solar panel industry will exert a strain on silver supply so significant that 85-98% of global silver reserves are forecasted to be depleted.

RARE EARTH ELEMENTS: a set of 17 nearly indistinguishable lustrous silvery-white soft heavy metals.

In the renewable technology sector, rare earth elements are essential for the magnets used in wind turbines and electric vehicle batteries. Rare earth elements are widely considered to be “the seeds of technology” having made many of today’s everyday technologies possible (ex. cell phones, computers).

Over the next two decades, the demand for rare earth elements from the renewable energy sector is expected to rise above 40% of all demand for rare earth elements. Today, demand for rare earth elements from the renewable energy sector is only 16% of total demand, one-third of what demand is expected to be by 2040.

Can Earth’s supply of rare earth elements meet its surge in demand? The news is not good here either. Terbium, praseodymium, neodymium, and dysprosium, minerals essential to wind turbines, all face challenges crossing the finish line to meet demand. By 2030, demand for terbium could already exceed 100% of supply, demand for praseodymium could reach more than 175% of supply, and demand for neodymium and dysprosium could exceed a staggering 250% of anticipated supply.

A tight supply of lithium, silver, and rare earth elements will delay the production of key renewable energy technologies: electric vehicle batteries and battery storage, solar panels, and wind turbines, just to name a few. Likely, we will fail to meet crucial milestones for reducing carbon emissions.

However, understanding the problem as a ratio of supply and demand opens our eyes to the real existential issue. The root of our climate woes is not carbon pollution per se. Rather, the root of the problem is our reliance on a finite Earth to supply a limitless and infinitely growing demand for energy.

Read on in The Paradox of Clean Energy: Part 2 of this blog series where I dig further into the root of the problem.

What are potential solutions? Is it all hopeless?

Read my next blog post to find out!

What’s your email? Stay updated when a new blog post is published!

Leave a comment